Here in the US, we tend to assume that we are on the technology vanguard, quickly adopting the latest and greatest products. While this may be the case in many segments, it most certainly is not true in the payments space. One area in particular where the US is playing catchup is in mobile payments.

Sure, Apple Pay and Google Pay are picking up steam and are the clear market leaders in the US (with an honorable mention to the Starbucks mobile app). But they still don’t hold a candle to the leading mobile payment services in other parts of the world.

M-Pesa: Bringing Mobile Payments to the Underbanked in Africa

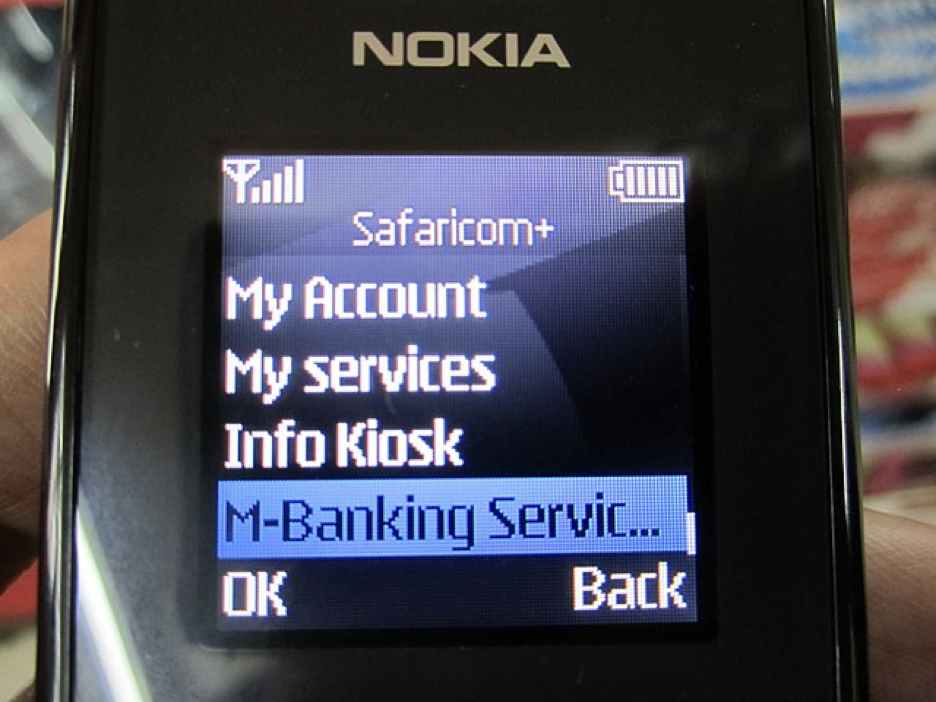

When I first saw M-Pesa in action in Kenya several years ago, I was struck by its simplicity. Designed to work effectively on a basic mobile phone, the service relies on simple menus and all actions can be enabled by a numerical keypad. No need for an expensive touchscreen iPhone or Android phone. From what I could see, M-Pesa is ubiquitous across the country, from the sprawling metropolis of Nairobi to remote villages where the lack of electricity forces villagers to use portable solar panels to charge their phones.

Currently M-Pesa is used by over 42 million people across 7 African countries: the Democratic Republic of Congo, Egypt, Ghana, Kenya, Lesotho, Mozambique and Tanzania. Compare this to Apple Pay in the US, which has only 30 million users. Penetration is also greater, with 12% of the population in those 7 countries using M-Pesa, vs just 8% of Americans using Apple Pay. And from what I saw in Kenya, even the smallest roadside kiosk offers top up services for users to add funds to their M-Pesa account.

A second reason for its popularity is the range of M-Pesa use cases. Not only can a person use their phone to make retail purchases from most stores, from large retailers to tiny roadside stands, but many companies also pay salaries to their employees via the service. A number of government services and non-government organizations also distribute funds to remote recipients using M-Pesa. And with over 400,000 local agents spread across the countryside, topping up an account is simple and easy.

While the service may seem rudimentary to our Western eyes, M-Pesa is actually remarkably full featured. It’s also a prime example of how a service can be effectively optimized for a target market, in this case a highly unbanked population predominantly using basic mobile phones. It’s clear that innovation doesn’t always mean the highest-tech solution, but one that effectively enables users to do what they need or want to do in the simplest and most accessible way possible.